The gross GST revenue collected in the month of September, 2020 is ₹ 95,480 crore of which CGST is ₹ 17,741 crore, SGST is ₹ 23,131 crore, IGST is ₹ 47,484 crore (including ₹ 22,442 crore collected on import of goods) and Cess is ₹ 7,124 crore (including ₹ 788 crore collected on import of goods).

The government has settled ₹ 21,260 crore to CGST and ₹ 16,997 crore to SGST from IGST as regular settlement. The total revenue earned by Central Government and the State Governments after regular settlement in the month of September, 2020 is ₹ 39,001 crore for CGST and ₹ 40,128 crore for the SGST.

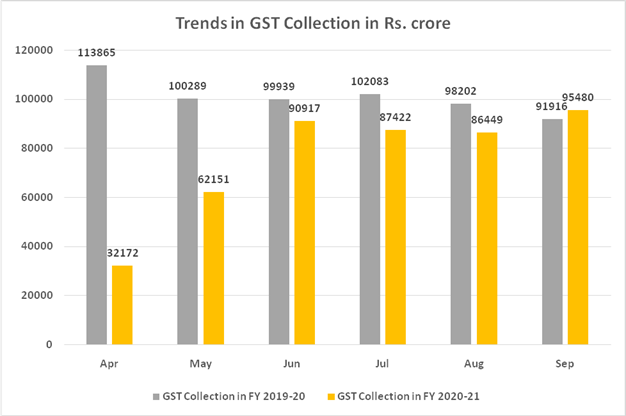

The revenues for the month are 4% higher than the GST revenues in the same month last year. During the month, the revenues from import of goods were 102% and the revenues from domestic transaction (including import of services) were 105 % of the revenues from these sources during the same month last year.

The chart shows trends in monthly gross GST revenues during the current year as compared to September 2019 and for the full year.

(Also read: Divorced daughter will be entitled to receive Family Pension)

(Also read: Faceless Appeals launched by CBDT)

(Also read: First RRTS train of India to run between Delhi-Meerut with modern features)

(Also read: No requirement of scrip wise reporting in ITR for day trading and short-term sale or purchase of listed shares)

(Also read: Government relaxes timeline for submission of Life Certificate for further continuation of pension)

(Also read: File complaint if any detail on product package is not legible or missing)

(Also read: Revised instructions on opening of Current Accounts)

Disclaimer: The above post includes some content used from PIB India website and executed on this website for fair use only. As this website is of educational nature, hence the content is used for education and awareness to the public.