A taxpayer may now file NIL Form GSTR-3B, through an SMS, apart from filing it through online mode, on GST Portal. This would substantially improve ease of GST compliance for over 22 lakh registered taxpayers who had to otherwise log into their account on the common portal and then file their returns every month. Now, these taxpayers with NIL liability need not log on to the GST Portal and may file their NIL returns through a SMS.

To file NIL Form GSTR-3B through SMS, the taxpayer must fulfill following conditions:

- They must be registered as Normal taxpayer/ Casual taxpayer/ SEZ Unit / SEZ Developer.

- They have valid GSTIN.

- Phone number of Authorized signatory is registered on the GST Portal.

- There is no pending tax liability for previous tax periods, interest or late fee.

- All GSTR-3B returns for previous tax periods are filed.

- No data should be in saved stage for Form GSTR-3B on the GST Portal, related to that respective month.

- NIL Form GSTR-3B can be filed anytime on or after the 1st of the subsequent month for which the return is to be filed.

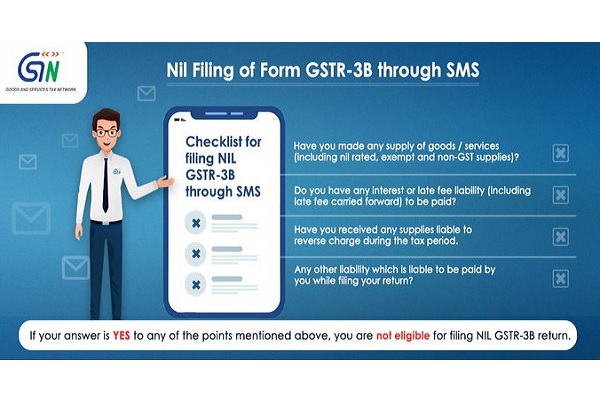

NIL Form GSTR-3B for a tax period must be filed if the taxpayer:

- Has NOT made any Outward Supply

- Do NOT have any reverse charge liability

- Do NOT intend to take any Input tax credit; and

- Do NOT have any liability for that particular or previous Tax Periods.

All the authorized representatives, for a particular GSTIN can file NIL Form GSTR-3B through SMS:

- If more than one authorized representative/ signatory have the same mobile number registered on the GST Portal, such SMS requests will not be accepted for filing NIL Form GSTR-3B.

- An SMS and e-mail will be sent on the e-mail and mobile number of the primary authorized signatory.

- In case, filer of NIL Form GSTR-3B is an authorized signatory, SMS will be sent to his/her mobile number also.

- Taxpayer can file NIL Form GSTR-3B, through SMS for all GSTINs, for whom they are an Authorized Signatory, using same mobile number.

Click here for FAQs on how to file Nil GST Return through SMS.

(Also read: FAQs on how to file Nil GST Return through SMS)

(Also read: Safeguard yourself from fake messages on GST Refund)

(Also read: Update on issue of GST late fee for the period August 2017 to January 2020)

(Also read: Centre releases Rs.36,400 crore as GST compensation to States)

(Also read: EPFO Pensioners to get Enhanced Pension)

Disclaimer: The above post includes some content used from GST website and executed on this website for fair use only. As this website is of educational nature, hence the content is used for education and awareness to the public.