Que.1: What is the difference between SPICe and SPICe+?

Ans: While SPICe is an eform, SPICe+ is an integrated Web form offering 10 services by 3 Central Govt Ministries & Departments. (Ministry of Corporate Affairs, Ministry of Labour & Department of Revenue in the Ministry of Finance) and One State Government (Maharashtra), thereby saving as many procedures, time and cost for Starting a Business in India. SPICe+ is part of various initiatives and commitment of Government of India towards Ease of Doing Business (EODB).

Que.2: What is the first step for availing the Incorporation services through SPICe+ Web form?

Ans: SPICe+ Web form is a post-login service and existing registered users would need to login into their account using their credentials. New users are required to create a login account first before using the service.

Que.3: What is ‘Application Number’?

Ans: Application Number refers to a system generated number given to an application for Name reservation/Incorporation which is yet to be submitted/uploaded by the user.

Que.4: What is Part A of SPICe+ and can the same be filed separately?

Ans: Name(s) of a company can be reserved in Part A of SPICe+. In case the applicant wants to apply for name, incorporation and other integrated services together, he can do so together by filling necessary information in Part A and Part B.

Que.5: What are the new fields introduced in Part A of SPICe+ while reserving names?

Ans: New fields introduced are:

(i) Type* of company

(ii) Class of company

(iii) Category of company

(iv) Sub-Category of company

(v) Main division of industrial activity of the company

(vi) Description of the main division.

*Hitherto entity type

Que.6: What is to be entered in the space “Proposed name” in Part A of SPICe+?

Ans: User has to enter the name he wants to reserve, for incorporation of a new company or for changing the name of an existing company. Users are requested to ensure that the proposed name selected does not contain any word which is prohibited under Section 4(2) & (3) of the Companies Act, 2013 read with Rule 8 of the Companies (Incorporation) Rules, 2014. Users are also requested to read and understand Rule 8 of the Companies (Incorporation) Rules, 2014 in respect of any proposed name before applying for the same.

For Name Search: http://www.mca.gov.in/mcafoportal/showCheckCompanyName.do

Stakeholders are requested to also check the Trademark search to ensure that the proposed name is not in violation of provisions of Section 4(2) of the Companies Act, 2013, failing which it is liable to be rejected.

For Trade Mark Search: http://www.ipindia.nic.in/index.htm

Que.7: Whether two names would be permitted in Part A of SPICe+ if applied separately?

Ans: Yes. However, a fee of INR 1000 becomes payable if applied separately.

Que.8: Is it mandatory to attach documents while reserving name through Part A of SPICe+?

Ans: No. However, it would be mandatory to attach relevant documents and No Objection Certificates(NOCs) in Part A of SPICe+ only when a name which requires the approval of a Sectoral Regulator or NoC etc. if applicable, as per the Companies(Incorporation) Rules, 2014, is being applied for. Please note that only one file is allowed to be uploaded as an attachment and the size of the file should not exceed 6MB in case of Part A SPICe+ and overall limit of form size shall not exceed 6MB in case both Part A SPICe+ and Part B SPICe+ are filed together. In case of multiple attachments for Part A SPICe+, please scan all documents into a single file and upload the same.

Que.9: Can a user who has an approved name using Part A of SPICe+, permit other users/applicants to use the name for filing Part B of SPICe+?

Ans: No. The same user login ID which was used for reserving the name has to be used for submitting and uploading SPICe+ and other linked forms.

Que.10: Will Zero Filing Fee be applicable for Companies getting incorporated through SPICe+ with Authorized Capital up to INR 15,00,000?

Ans: Yes. Companies getting incorporated through SPICe+ with an Authorized Capital up to INR 15,00,000 would continue to enjoy ‘Zero Filing Fee’ concession.

Que.11: Is there any change in number of RSUB chances while filing Part A separately for reserving name(s) or while filing Part A and B of SPICe+ together for integrated incorporation?

Ans: No. RSUB chances would remain the same.

Que.12: What are various services offered in Part B of SPICe+?

Ans: Part B of SPICe+ offers following services viz. (i) Incorporation (ii) DIN allotment (iii) Mandatory issue of PAN (iv) Mandatory issue of TAN (v) Mandatory issue of EPFO registration (vi) Mandatory issue of ESIC registration (vii) Mandatory issue of Profession Tax registration (Maharashtra) (viii) Mandatory Opening of Bank Account for the Company and (ix) Allotment of GSTIN (if so applied for).

Que.13: Under what circumstances RUN Service would be applicable?

Ans: From 23rd February 2020 onwards, RUN service would be applicable only for ‘change of name’ of an existing company.

Que.14: How many times changes/modifications to SPICe+ (after generating pdf and affixing DSCs) can be made?

Ans: Changes/modifications to SPICe+ (even after generating pdf and affixing DSCs), can be made up to five times by editing the same web form application which has been saved, generating the updated pdf affixing DSCs and uploading the same.

Que.15: What is the procedure after filling the SPICe+?

Ans: Once the SPICe+ is filled completely with all relevant details, the same would then have to be converted into pdf format, with just a click of the mouse button, for affixing DSCs. Thereafter all digitally signed applications can be uploaded along with the linked forms as per the hitherto process.

Que.16: Is Registration for Profession Tax through SPICe+ mandatory all over India?

Ans: No. Registration for Profession Tax shall be mandatory through SPICe+ only in respect of new companies incorporated in the State of Maharashtra w.e.f 23rd February 2020.

Que.17: Is Registration for EPFO and ESIC through SPICe+ shall be mandatory for all new companies incorporated all over India?

Ans: Yes. Registration for EPFO and ESIC shall be mandatory for all new companies incorporated w.e.f 23rd February 2020 and no EPFO & ESIC registration nos. shall be separately issued by the respective agencies.

Que.18: Is Opening of Bank Account mandatory for all companies incorporated through SPICe+?

Ans: Yes. All new companies incorporated through SPICe+ (w.e.f 23rd February 2020) would also be mandatorily required to apply for opening the company’s Bank account through the AGILE-PRO linked web form.

Que.19: How many Banks have been integrated through SPICe+?

Ans: Presently Punjab National Bank has been integrated with SPICe+ for opening a Bank account. Gradually many Public and Private Sectors Banks would also be integrated with SPICe+. Suitable updates in this regard would be published on the MCA portal and FAQs.

Que.20: Is any Fee payable by companies at the time of incorporation for opening Bank A/c through SPICe+?

Ans: No.

Que.21: Is it mandatory for every subscriber and/or directors to obtain DSC now?

Ans: Yes. In case number of subscribers and/or directors to eMoA and eAoA is up to twenty and all such subscribers and/or directors have DIN/PAN, it shall be mandatory for each one of them to obtain a DSC.

Que.22: Under which role DSC needs to be associated for First directors not having DIN/subscribers?

Ans: First directors not having DIN/Subscribers having PAN shall associate their DSC under 'authorised representative' by providing their PAN. Once DIN is allocated for first directors post approval of SPICe+, DSC may be updated against DIN by using 'Update DSC' service.

Que.23: How INC-9 (Declaration by all Subscribers and first Directors) would be generated?

Ans: INC-9 shall be auto-generated in pdf format and would have to be submitted only in electronic form in all cases, except where: (i) Total number of subscribers and/or directors is greater than 20 and/or (ii) Any such subscribers and/or directors has neither DIN nor PAN.

Que.24: What is AGILE-PRO?

Ans: AGILE-PRO contains application for GSTIN/EPFO/ESIC/Profession Tax Registration (in Maharashtra) and Opening of Bank A/c.

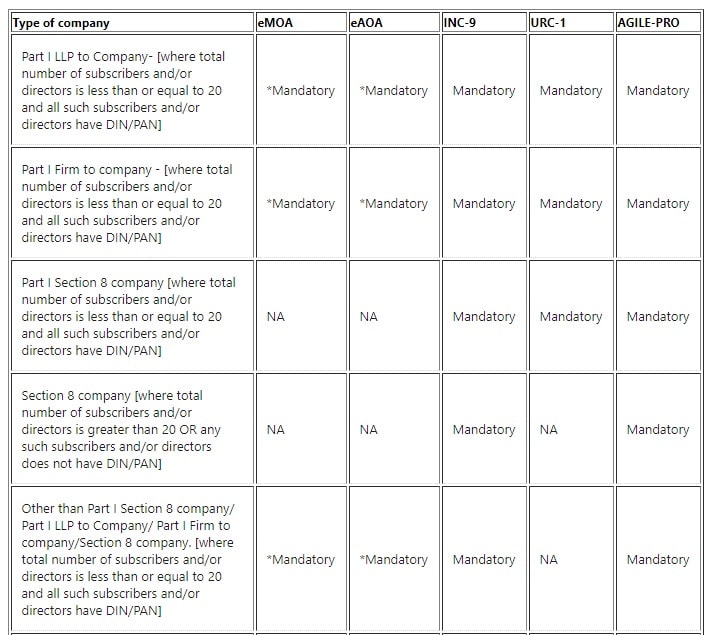

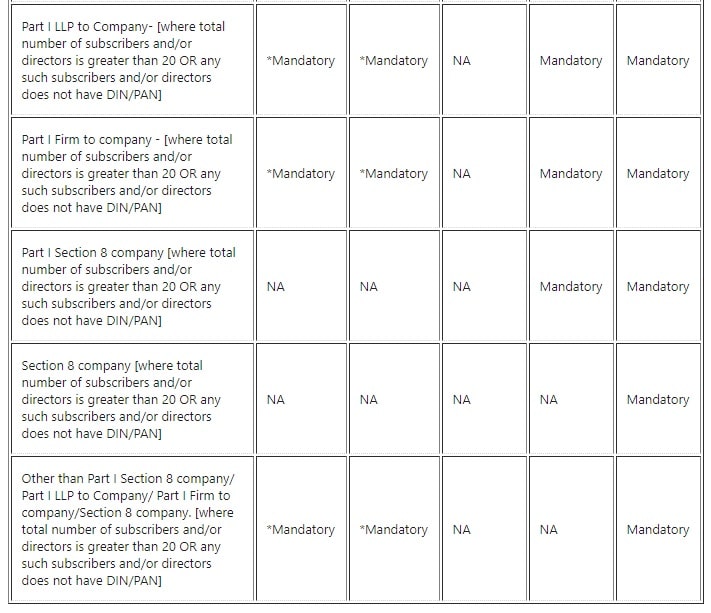

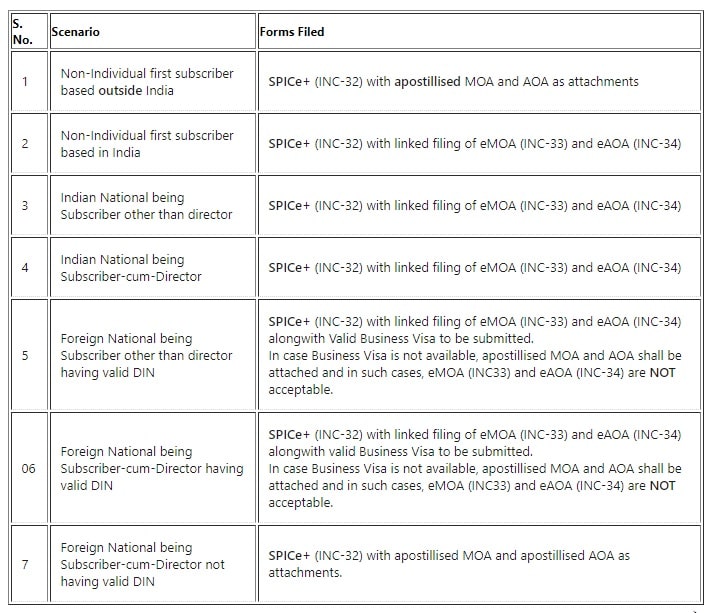

Que.25: What are the linked forms to be filed along with SPICe+? Are there any exceptional scenarios in which pdf attachments (MOA, AOA) should be used instead of eMoA, eAoA with SPICe+ (INC-32)?

Ans: The table below clarifies the specific scenarios and list of linked forms to be filed with SPICe+ (INC-32) and along with exceptional scenarios:

*Stakeholders are required to file e-MoA and e-AoA i.e. by way of linked filing of INC-33 and INC-34 in all cases except the following:

- Section 8 company selected in field 1 (a) or

- all or any of the non-individual first subscribers are based outside India or

- Part I Section 8 company selected in field 1 (a) or

- Number of subscribers entered in the field 8(a) ‘Total number of first subscribers (non-individual + individual)’ are more than seven

- Individual foreign subscribers do not possess a valid business visa

In case of the above-mentioned exception(s), MoA and AoA shall always be attached under the Attachments section of SPICe+ form (INC-32).

Que.26: What is the sequence of uploading linked forms to SPICe+?

Ans: SPICe+

e MOA [if applicable]

e AOA [if applicable]

URC-1 [if applicable]

AGILE-PRO [mandatory in all the cases]

INC-9 [if applicable]

Que.27: Is it mandatory to use eMoA and eAoA? Can physical copies of MoA/AoA be signed and attached with SPICe+ forms?

Ans: Yes. It is mandatory to use eMoA (INC-33) and eAoA (INC-34) in case the number of subscribers are up to 7 and in the following scenarios:-

- individual subscribers are Indian nationals

- individual subscribers who are foreign nationals in case they valid DIN and DSC and also submit a proof of a valid business visa

- non-individual subscribers based in India.

Physical copies of MoA/AoA is required to be signed and attached in case non-individual first subscribers are based outside India or individual foreign subscribers do not possess a valid business visa or any other scenario as mentioned in FAQ Que.28 in detail.

Que.28: What are the exceptional scenarios in which pdf attachments (MOA, AOA) should be used instead of eMoA, eAoA with SPICe +(INC-32)?

Ans: The table below clarifies the specific scenarios in which the pdf attachments or electronic versions of MoA/AoA can be used with SPICe+ (INC-32):

Que.29: Can I attach MOA and AOA for few subscribers and form INC-33(eMOA) and INC-34(eAOA) for other subscribers for same company?

Ans: No. In case the proposed company is required to file MOA and AOA due to any of the above mentioned conditions, then SPICe+ (INC-32) shall be filed ONLY with MOA and AOA as an attachment for all the subscribers. In such cases, the proposed company is NOT required to file the eMOA and eAOA under any circumstances.

Que.30: If a body corporate is one of the subscribers/promoters, can DSC of an authorized Director be affixed?

Ans: Yes.

Que.31: In e-AOA (INC-34) if additional Article is required, how to enter the same?

Ans: e-MOA (INC-33) has facility for adding, modifying, and deleting Articles.

Que.32: Can we enter the conditions of private company as required under Section 5 of the Companies, Act, 2013 in e-AOA (INC-34)?

Ans: Yes, e-AOA (INC-34) has facility for adding, modifying, and deleting Articles. Stakeholder are required to ensure that clause 1 of e-AOA (INC-34) includes name of the private limited company and definition of private limited company.

Que.33: Can we enter the names of first directors as required under Companies Act, 2013, in e-AOA (INC-34)?

Ans: Yes, e-AOA (INC-34) has facility for adding, modifying, and deleting Articles.

Que.34: What is the process for obtaining approved e-MOA (INC-33) and e- AOA (INC-34)?

Ans: The users may obtain approved e-MOA (INC-33) and e- AOA (INC-34) through certified copies facility available on MCA.

Que.35: Whether eMOA (INC-33) and eAOA (INC-34) is to be filed with SPICe+ (INC-32) in respect of non-individual first subscribers who are based outside India?

Ans: No. In respect of non-individual first subscribers who are based outside India, pdf attachments of apostilled MOA and AOA shall be attached with SPICe+(INC-32).

Que.36: Is a proposed Section 8/ Part 1 Section 8 company required to file eMOA (INC-33), eAOA (INC-34) along with SPICe+ (INC-32)?

Ans: No. Section 8/Part 1 Section 8 companies are mandatorily required to file MOA and AOA as pdf attachments to SPICe+ (INC-32).

Que.37: Is a proposed Part I company required to file eMOA (INC-33), eAOA (INC-34) along with SPICe+ (INC-32)?

Ans: No. Part I companies are mandatorily required to file MOA and AOA as pdf attachments to SPICe+ (INC-32) along with form URC-1 which is to be filed as a linked form.

Que.38: Is INC-22 still required to be filed with SPICe+?

Ans: It is not required to be filed with SPICe+ if a company is registered with the same address as the address for correspondence. In case the registered address is different, INC-22 is required to be filed within 30 days of its incorporation, for intimating the registered office address.

Que.39: What if there are more than seven subscribers to MoA and AoA?

Ans: SPICe+ form shall be filed with MoA and AOA as attachments in case of more than seven subscribers.

Que.40: In case of subscriber to the memorandum is a foreign national residing outside India, his signatures and address etc. shall be witnessed by a Notary Public/Embassy/Consulate offices of Embassies as per the Rule 13 of the Companies (Incorporation) Rules, 2014. In such cases, how the DSC of such a witness be affixed?

Ans: In such cases, SPICe+ (INC-32) shall be filed with manually signed and duly attested MoA and AoA.

Que.41: Whether subscribers’ photo is required in SPICe+ forms?

Ans: No. Subscribers’ photo is not required.

Que.42: How many resubmissions are permitted for SPICe+ forms?

Ans: Two.

Que.43: What are the different types of Part I companies can be incorporated?

Ans: Part I company can now be incorporated as Part I Section 8 Company/ Part I LLP to Company/ Part I Firm to Company.

Que.44: What is LLPIN and when does it have to be entered?

Ans: LLPIN is LLP Identification Number and it has to be entered only when an existing LLP wishes to convert itself into a company. Please note that in case of conversion of LLP to company, the proposed name shall be the name of the existing LLP except for the change in suffix ‘LLP/Limited Liability Partnership’. Also, State entered should be same as the State in which the registered office of LLP is situated.

Que.45: Is it mandatory to file INC-12 to incorporate Section 8/Part I Section 8 Company?

Ans: No. License number for Section 8/ Part I Section 8 company shall be issued through SPICe+ form Form INC-12 shall not be filed for obtaining license number for new company incorporation.

Que.46: What is the word limit for writing objects in eMoA?

Ans: For main Objects (Field 3(a)), character limit is 20,000 and for furtherance of objects (Field 3(b)), it is 1,00,000 characters.

Que.47: Please clarify on attestation requirements in respect of foreign companies wanting to form a subsidiary in India?

Ans: Attestation requirements will be as per Rule 13 of the Companies (Incorporation) Rules, 2014.

Que.48: Is eMoA (INC-33) and eAoA (INC-34) to be uploaded separately?

Ans: eMoA and eAoA have to be uploaded as ‘Linked Forms’ to SPICe+ (INC-32).

Que.49: What if the subscribers to eMoA and eAOA are at different places as only one witness is provided?

Ans: eMoA and eAOA would be witnessed after all subscribers have signed as is happening presently.

Que.50: Is refund applicable if SPICe+ forms get rejected?

Ans: Yes

Que.51: What is the maximum upload size of SPICe+ forms?

Ans: 6 MB for each of the PDF form.

Que.52: Can NIDHI Company be incorporated using SPICe+ forms?

Ans: Yes. Type of company shall be selected as ‘Nidhi company’.

Que.53 Is it mandatory to apply for PAN and TAN along with SPICe+ (INC-32)?

Ans: Yes

Que.54: What is the Fee payable for PAN and TAN?

Ans: For PAN-Rs.66 and TAN-Rs.65 becomes payable.

Que.55: On approval of SPICe+ how PAN & TAN is communicated to the user?

Ans: On approval of SPICe+ forms, the Certificate of Incorporation (CoI) is issued with PAN as allotted by the Income Tax Department. An electronic mail with Certificate of Incorporation (CoI) as an attachment along with PAN and TAN is also sent to the user. Further PAN card shall be issued by the Income Tax Department.

Que.56: Whether fee towards PAN and TAN is payable separately?

Ans: No. A consolidated challan gets generated at the time of filing SPICe+(INC-32) which shall contain applicable fee towards:

(i) Form Fee

(ii) MoA

(iii) AoA

(iv) PAN

(v) TAN

Que.57: Please provide the contact details of officer responsible if PAN Card is not received by the user?

Ans: After receipt of Certificate of Incorporation (with PAN indicated therein as allotted by the Income Tax Department) in case of non-receipt of PAN card, stakeholders shall check the status at www.TIN-NSDL.com

Que.58: Are AO codes for PAN and TAN different? Where can one find these AO Codes?

Ans: AO codes for PAN and TAN are different and can be found at links below. Please do not affix or suffix zeros to AO codes.

AO Codes for PAN https://www.tin-nsdl.com/services/pan/pan-aocode.html

AO Codes for TAN https://www.tin-nsdl.com/services/tan/tan-ao-code.html

Example: AO code for PAN for Dilshad Garden area in Delhi is DEL W 64 1 while AO code for TAN Delhi is DEL W 391 1

Que.59: What is the mode of grievance redressal?

Ans: In case of technical problems i.e., form upload, pre-scrutiny errors, DSC related, payment related queries, please raise a ticket on www.mca.gov.in/myservices and await a resolution. You may also call up Corporate Seva Kendra at 0124-4832500 after 48 hours if ticket is not resolved. In case of resubmission / rejection remarks, please contact 0124-4832500 and select option 1 for CRC. For escalation you may send a mail to crc.escalation@mca.gov.in

Que.60: What if an applicant for allotment of Director Identification Number (DIN) has been identified as a potential duplicate in SPICe+?

Ans: If SPICe+ form is filed containing details of a DIN applicant who has been identified as a potential duplicate following message shall be displayed along with ‘Yes’ and ‘No’ options- “The system has identified applicant(s) as potential duplicate because the contents are matching with an already filed DIN application form. Please ensure that no DIN has already been allotted to the applicant. If you still wish to continue say ‘Yes’. Please note that DIN application shall be approved only after due verification by MCA “. If the user selects ‘No’, then the filing of eForm shall not be allowed.

Disclaimer: The above post includes some content used from MCA website and executed on this website for fair use only. As this website is of educational nature, hence the content is used for education and awareness to the public.