The gross GST revenue collected in the month of December, 2019 is ₹ 1,03,184 crore of which CGST is ₹ 19,962 crore, SGST is ₹ 26,792 crore, IGST is ₹ 48,099 crore (including ₹ 21,295 crore collected on imports) and Cess is ₹ 8,331 crore (including ₹ 847 crore collected on imports). The total number of GSTR 3B Returns filed for the month of November up to 31st December, 2019 is 81.21 lakh.

The GST revenues during the month of December, 2019 from domestic transactions has shown an impressive growth of 16% over the revenue during the month of December, 2018. If we consider IGST collected from imports, the total revenue during December, 2019 has increased by 9% in comparison to the revenue during December, 2018. During this month, the IGST on import of goods has seen a negative growth of (-) 10%, but is an improvement over (-) 13% last month and (-) 20% in the month of October.

The government has settled ₹ 21,814 crore to CGST and ₹ 15,366 crore to SGST from IGST as regular settlement. The total revenue earned by Central Government and the State Governments after regular settlement in the month of December, 2019 is

₹ 41,776 crore for CGST and ₹ 42,158 crore for the SGST.

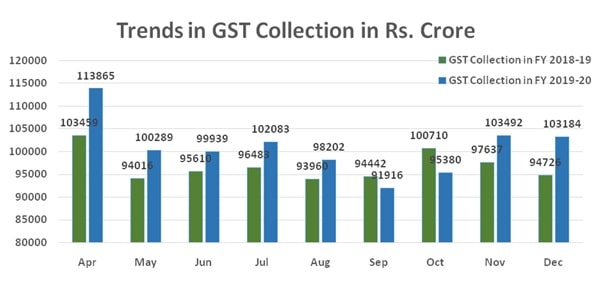

The chart shows trends in revenue during the current year:

(Also read: Anti-Evasion wing of CGST Delhi detects GST fraud of Rs 241 Crores)

(Also read: MCA deactivates 19.40 lakhs Director Identification Numbers)

(Also read: MCA launches Independent Director’s databank)

(Also read: CBSE 2020 Exams Date Sheet released)

(Also read: Availability of NEFT System on 24x7 basis)

(Also read: Modern Train Control System to be implemented on Indian Railways)

Disclaimer: The above post includes some content used from PIB India website and executed on this website for fair use only. As this website is of educational nature, hence the content is used for education and awareness to the public.