The total gross GST revenue collected in the month of September, 2019 is ₹ 91,916 crore of which CGST is ₹ 16,630 crore, SGST is ₹ 22,598 crore, IGST is ₹ 45,069 crore (including ₹ 22,097 crore collected on imports) and Cess is ₹ 7,620 crore (including ₹ 728 crore collected on imports). The total number of GSTR 3B Returns filed for the month of August up to 30th September, 2019 is 75.94 lakh.

The government has settled ₹ 21,131 crore to CGST and ₹ 15,121 crore to SGST from IGST as regular settlement. The total revenue earned by Central Government and the State Governments after regular settlement in the month of September, 2019 is ₹ 37,761 crore for CGST and ₹ 37,719 crore for the SGST.

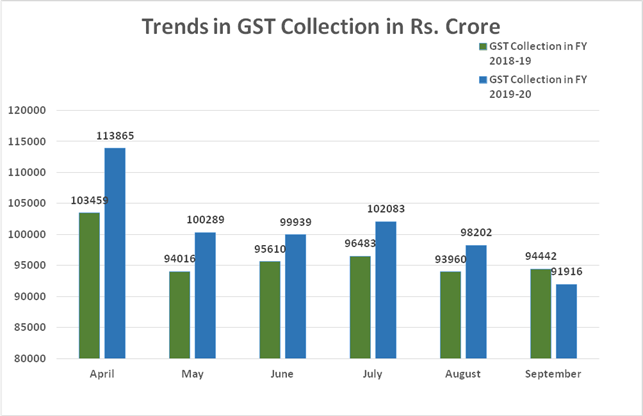

The revenue during September, 2019 is declined by 2.67% in comparison to the revenue during September, 2018. During April-September, 2019 vis-à-vis 2018, the domestic component has grown by 7.82% while the GST on imports has shown negative growth and the total collection has grown by 4.90%.

The chart shows trends in revenue during the current year.

(Also read: Racket of issuance of invoices without actual supply of goods busted in Delhi)

(Also read: Union Consumer Affairs Minister launches Consumer App)

(Also read: Insurance cover for Banks enhanced up to 90% for Working Capital Loans)

(Also read: Clarification on applicability of TDS on cash withdrawals)

(Also read: PM Modi launches National Pension Scheme for Traders and Self Employed Persons)

(Also read: Election Commission of India launches a One Stop Solution to verify and authenticate voter details)

Disclaimer: The above post includes some content used from PIB India website and executed on this website for fair use only. As this website is of educational nature, hence the content is used for education and awareness to the public.