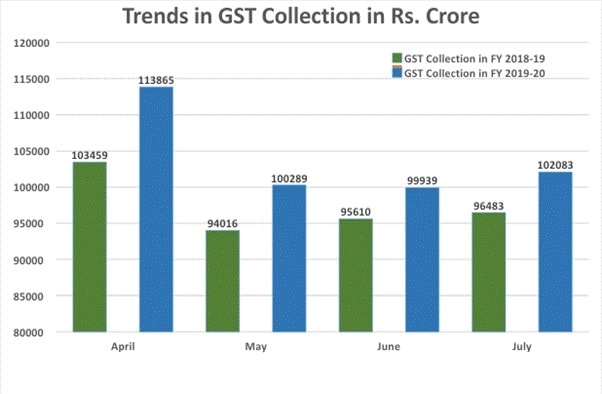

The total gross GST revenue collected in the month of July, 2019 is ₹ 1,02,083 crore of which CGST is ₹ 17,912 crore, SGST is ₹ 25,008 crore, IGST is ₹ 50,612 crore (including ₹ 24,246 crore collected on imports) and Cess is ₹ 8,551 crore (including ₹797 crore collected on imports). The total number of GSTR 3B Returns filed for the month of June up to 31st July, 2019 is 75.79 lakh.

The revenue in July, 2018 was ₹ 96,483 crore and the revenue during July, 2019 is a growth of 5.80% over the revenue in the same month last year. During April-July 2019 vis-à-vis 2018, the domestic component has grown by 9.2% while the GST on imports has come down by 0.2% and the total collection has grown by 6.83%. Rs. 17,789 crore has been released to the states as GST compensation for the months of April-May, 2019.

The chart shows trends in revenue during the current year.

(Also read: GST rate on all Electric Vehicles reduced from 12% to 5%)

(Also read: Extension of due date for filing of Income Tax Returns)

(Also read: Government reduces the rate of ESI contribution from 6.5% to 4%)

Disclaimer: The above post includes some content used from PIB India website and executed on this website for fair use only. As this website is of educational nature, hence the content is used for education and awareness to the public.