Total gross GST revenue collected in the month of June, 2019 is ₹ 99,939 crore of which CGST is ₹ 18,366 crore, SGST is ₹ 25,343 crore, IGST is ₹ 47,772 crore (including ₹ 21,980 crore collected on imports) and Cess is ₹8,457 crore (including ₹ 876 crore collected on imports). The total number of GSTR 3B Returns filed for the month of May up to 30th June, 2019 is 74.38 lakh.

The Government has settled ₹ 18,169 crore to CGST and ₹ 13,613 crore to SGST from IGST as regular settlement. The total revenue earned by Central Government and the State Governments after regular settlement in the month of June, 2019 is ₹ 36,535 crore for CGST and ₹ 38,956 crore for the SGST.

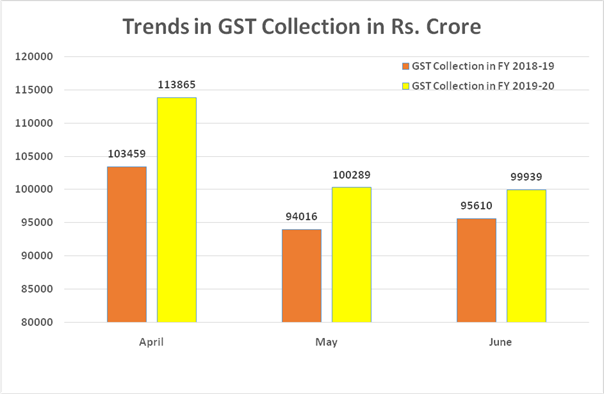

Revenue in June, 2018 was ₹ 95,610 crore and the revenue during June, 2019 is a growth of 4.52% over the revenue in the same month last year. The revenue in June, 2019 is 1.86% higher than the monthly average of GST revenue in FY 2018-19 (₹ 98,114 crore).

The chart shows trends in revenue during the current year.

(Also read: GST Council decision relating to changes in law and procedure)

(Also read: Government reduces the rate of ESI contribution from 6.5% to 4%)

(Also read: NEFT and RTGS charges will be waived from 1 July 2019)

(Also read: Signature of parents on CBSE Class X Marksheet cum Certificate for declaration of correct information)

Disclaimer: The above post includes some content used from PIB India website and executed on this website for fair use only. As this website is of educational nature, hence the content is used for education and awareness to the public.