The total gross GST revenue collected in the month of January, 2019 is Rs 1,02,503 crore of which CGST is Rs 17,763 crore, SGST is Rs 24,826 crore, IGST is Rs 51,225 crore (including Rs 24,065 crore collected on imports) and Cess is Rs 8,690 crore (including Rs 902 crore collected on imports). In FY 2018-2019, it is for the third time that GST Revenue collection has crossed One Lakh Crore. The total number of GSTR 3B Returns filed for the month of December up to 31st January, 2019 is 73.3 lakh.

The government has settled Rs 18,344 crore to CGST and Rs 14,677 crore to SGST from IGST as regular settlement. The total revenue earned by Central Government and the State Governments after regular settlement in the month of December, 2018 is Rs 36,107 crore for CGST and Rs 39,503 crore for the SGST.

(Also read: Key Highlights of Budget 2019)

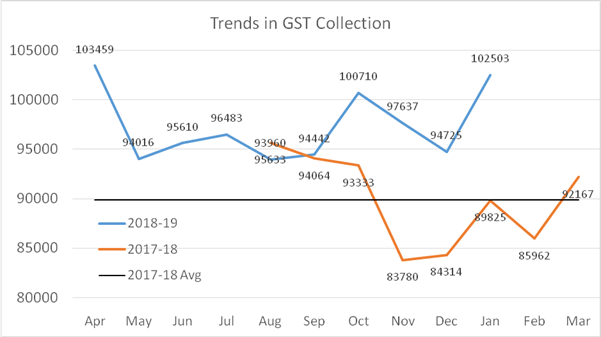

The collection in January 2019 is a significant increase from the collection of Rs 94,725 crore in December 2018, which was a decline from Rs 97,637 crore in November 2018 and Rs 1,00,710 crore in October 2018. January 2019 collections are 14% above the January 2018 collections of Rs 89,825 crore. This jump has been achieved despite various tax reductions having come into force that provided major relief to the consumers. The gross GST collections over the last three-month period have been 14% higher than the corresponding period last year.

The following Chart shows Trends in Revenue during the Current Financial Year 2018-19 as compared to the Last FY 2017-18:

GST Revenue during the Current Financial Year 2018-19 as compared to the Last FY 2017-18

GST Revenue during the Current Financial Year 2018-19 as compared to the Last FY 2017-18

(Also read: CBDT identifies non-filers through NMS and requests to submit Income Tax Return or Online Response)

(Also read: Scholarships for Girls to encourage better education and career opportunities)

(Also read: National Testing Agency launched Mobile App to practice Mock Tests for Competitive Exams)

(Also read: More than 1600 courses available on SWAYAM Platform)

Disclaimer: The above post includes some content used from PIB India website and executed on this website for fair use only. As this website is of educational nature, hence the content is used for education and awareness to the public.