- Taxable annual income up to Rs.5 lakhs will be exempted from tax. It means the persons having Gross income up to Rs.6.50 lakhs are not required to pay any income tax if they make investments in provident funds, specified savings and insurance etc allowed as deduction up to Rs.1,50,000 under section 80C of Income Tax Act, 1961.

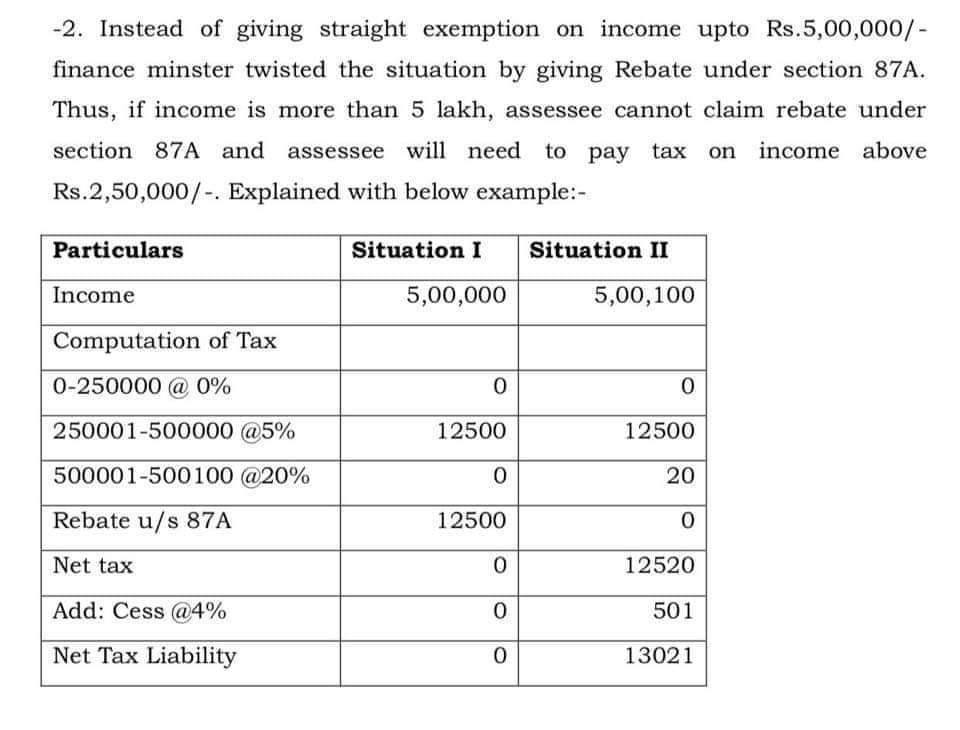

- Rebate under section 87A will be allowed up to Rs.12,500 with effect from the 1st day of April, 2019 (Financial Year 2019-2020), if total income is not more than Rs.5,00,000. For Example:

- For salaried persons, Standard Deduction is being raised from the current Rs.40,000 to Rs.50,000.

- Exemption on levy of income tax on notional rent (as Deemed rental income) on a second self-occupied house is also now proposed. Currently, income tax on notional rent is payable if one has more than one self-occupied house.

- TDS threshold on Interest earned on Bank/Post office deposits is being raised from Rs. 10,000 to Rs.40,000 (u/s 194A).

- TDS threshold for deduction of tax on Rent is proposed to be increased from Rs. 1,80,000 to Rs.2,40,000 (u/s 194I) for providing relief to small taxpayers.

- Tax free Gratuity limit increase to Rs.20 Lakhs from Rs.10 Lakhs.

- Capital tax Benefit u/s 54 has increased from investment in one residential house to two residential houses.

- Benefit u/s 80IB has increased to one more year i.e. 2020.

- Benefit has given to unsold inventory has increased from one year to two years.

- Farmers owning up to 2 hectares of land will get income support of Rs 6,000 per year. It will be transferred directly to the bank account of farmers in the three installments of Rs.2,000.

- Unorganized sector employees will get Rs. 3,000 per month pension.

- Income Tax Returns to be processed within 24 hours.

- Within nearly 2 years, almost all tax assessment and verifications of income tax returns will be done electronically without any intervention by officials.

- Soon, businesses with less than Rs.5 crore annual turnover, comprising over 90% of GST payers will be allowed to file quarterly return.

- Recommendations to GST council for reducing GST rates for home buyers.

- Custom duty has abolished from 36 Capital Goods.

- 26 weeks of Maternity Leaves to empower the women.

- Single window for approval of India film makers.

- 2% interest relief for MSME GST registered person.

- Bonus will be applicable for workers earning up to Rs.21,000 monthly.

(Also read: Threshold Limit for GST increased to 40 lakhs rupees from 20 lakhs rupees)

(Also read: Central Board of Direct Taxes (CBDT) clarifies regarding issue of Prosecution Notices)

(Also read: CBDT identifies non-filers through NMS and requests to submit Income Tax Return or Online Response)

.jpg)