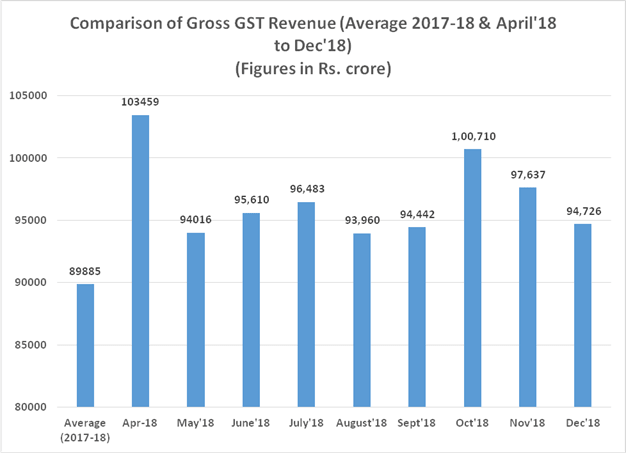

The total gross GST revenue collected in the month of December, 2018 is Rs. 94,726 crore of which CGST is Rs. 16,442 crore, SGST is Rs. 22,459 crore, IGST is Rs. 47,936 crore (including Rs. 23,635 crore collected on imports) and Cess is Rs. 7,888 crore (including Rs. 838 crore collected on imports). The total number of GSTR 3B Returns filed for the month of November up to 31st December, 2018 is 72.44 lakh.

The government has settled Rs. 18,409 crore to CGST and Rs. 14,793 crore to SGST from IGST as regular settlement. Further, Rs 18,000 crore has been settled from the balance IGST available with the Centre on provisional basis in the ratio of 50:50 between Centre and States. The total revenue earned by Central Government and the State Governments after regular settlement in the month of December, 2018 is Rs. 43,851 crore for CGST and Rs. 46,252 crore for the SGST.

The chart shows trends in revenue during the current year.

(Also read: Approach to Banking Ombudsman if the bank is not resolving your complaint)

(Also read: Decisions and Recommendations made in 31st GST Council meeting regarding Rate changes)

(Also read: Recommendations made during 31st Meeting of the GST Council)

Disclaimer: The above post includes some content used from PIB India website and executed on this website for fair use only. As this website is of educational nature, hence the content is used for education and awareness to the public.