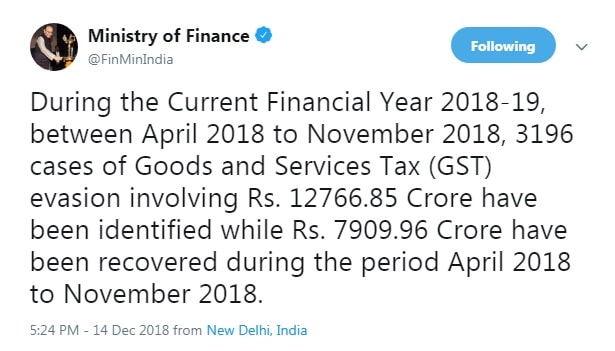

During the current financial year (between April 2018 to November 2018) 3196 cases involving an amount of Rs. 12766.85 Crore have been identified.

Suspected GST Evasion amounting to Rs. 12766.85 has come to the light till the month of November, 2018. An amount of Rs. 7909.96 Cr. has been recovered during the period April 2018 to November 2018. The State-Wise details of detection of GST Evasion cases and recovery are as under:

|

| Detection | Recovery | ||

S. N. | Name of the State/U.T | No. Of Cases | Amount (in Cr) | No. Of Cases | Amount (in Cr) |

1 | Andhra Pradesh | 38 | 359.01 | 26 | 235.68 |

2 | Arunachal Pradesh | 29 | 17.19 | 15 | 10.69 |

3 | Assam | 21 | 46.17 | 19 | 44.73 |

4 | Bihar | 182 | 490.01 | 167 | 484.02 |

5 | Chhattisgarh | 36 | 180.18 | 34 | 158.57 |

6 | Goa | 31 | 30.95 | 27 | 17.9 |

7 | Gujarat | 303 | 548.16 | 232 | 405.55 |

8 | Haryana | 210 | 757.19 | 172 | 301.23 |

9 | Himachal Pradesh | 10 | 37.7 | 8 | 4.35 |

Jammu & Kashmir | 25 | 109.67 | 20 | 40.45 | |

11 | Jharkhand | 145 | 494.6 | 105 | 246.27 |

12 | Karnataka | 127 | 844.17 | 66 | 594.99 |

13 | Kerala | 54 | 447.03 | 43 | 278.35 |

14 | Madhya Pradesh | 252 | 499.16 | 259 | 384.92 |

15 | Maharashtra | 418 | 3898.72 | 363 | 2475.27 |

16 | Manipur | 2 | 0.18 | 2 | 0.05 |

17 | Meghalaya | 7 | 34.35 | 7 | 33.89 |

18 | Mizoram | 0 | 0 | 0 | 0 |

19 | Nagaland | 0 | 0 | 0 | 0 |

20 | Odisha | 80 | 237.78 | 58 | 155.45 |

21 | Punjab | 75 | 60.69 | 70 | 40.19 |

22 | Rajasthan | 207 | 427.76 | 192 | 302.11 |

23 | Sikkim | 1 | 6 | 1 | 0.2 |

24 | Tamil Nadu | 148 | 757.34 | 101 | 426.47 |

25 | Telangana | 103 | 244.25 | 71 | 95.83 |

26 | Tripura | 8 | 3.85 | 4 | 0.19 |

27 | Uttar Pradesh | 233 | 998.62 | 185 | 605.59 |

28 | Uttarakhand | 24 | 119.82 | 19 | 59.08 |

29 | West Bengal | 225 | 336.36 | 209 | 157.73 |

30 | Delhi | 144 | 741.52 | 119 | 331.27 |

31 | Chandigarh | 7 | 2.8 | 5 | 3.23 |

32 | Daman & Diu | 10 | 8.44 | 10 | 8.64 |

33 | Dadar & Nagar Haveli | 6 | 1.75 | 5 | 1.67 |

34 | Puducherry | 35 | 25.43 | 20 | 5.4 |

35 | Andaman & Nicobar | 0 | 0 | 0 | 0 |

36 | Lakshadweep | 0 | 0 | 0 | 0 |

| Total | 3196 | 12766.85 | 2634 | 7909.96 |

The following measures are being taken by Government to check GST evasion:

- Intelligence based enforcement

- E-Way Bill squads

- Systematic Analysis of Data

- Setting-up of Directorate General (Analytics & Risk Management)

This was stated by Shri Shiv Pratap Shukla, Minister of State for Finance in a Written Reply to a question in Lok Sabha on December 14, 2018.

(Also read: CCTV Cameras in Trains and Railway Stations)

(Also read: Effective GST Rate on Complex, Building, Flat etc)

(Also read: Discontinuation of Mela Surcharge and Facilities at Stations for Kumbh Mela)

(Also read: School Syllabus proposed to be reduced to half, says Shri Prakash Javadekar)

Disclaimer: The above post includes some content used from PIB India website and executed on this website for fair use only. As this website is of educational nature, hence the content is used for education and awareness to the public.