The total gross GST revenue collected in the month of November, 2018 is Rs. 97,637 crore of which CGST is Rs. 16,812 crore, SGST is Rs. 23,070 crore, IGST is Rs. 49,726 crore (including Rs. 24,133 crore collected on imports) and Cess is Rs. 8,031 crore(including Rs. 842 crore collected on imports). The total number of GSTR 3B Returns filed for the month of October up to 30th November, 2018 is 69.6 lakh.

(Also read: Election Commission of India announced the Launch of Its Newly Designed Website)

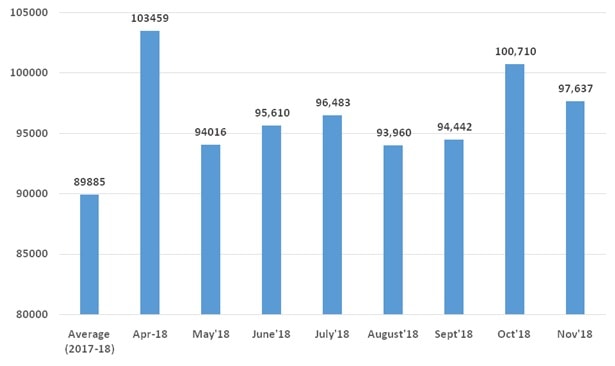

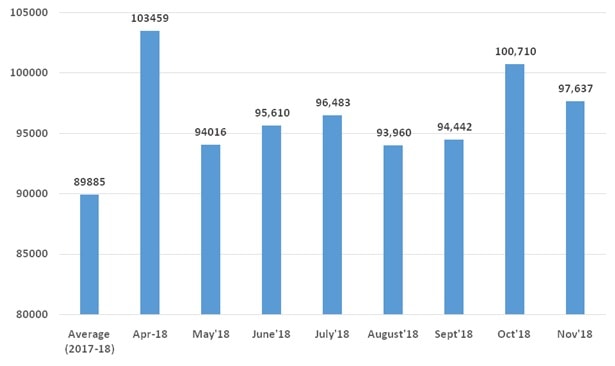

The government has settled Rs. 18,262 crore to CGST and Rs. 15,704 crore to SGST from IGST as regular settlement. The total revenue earned by Central Government and the State Governments after regular settlement in the month of November, 2018 is Rs. 35,073 crore for CGST and Rs. 38,774 crore for the SGST Rs. 11,922 crore has been released to the states as GST compensation for the months of August-September, 2018. The chart shows trends in revenue during the current year.

Comparison of Gross GST Revenue (Figures on Rs. Crore)

Comparison of Gross GST Revenue (Figures on Rs. Crore)

(Also read: Commerce Minister Launches Logo and Brochure of Logix India)

(Also read: Hausla 2018 of the Ministry of Women and Child Development inaugurated in New Delhi)

(Also read: PAiSA (Portal for Affordable credit and Interest Subvention Access), launched under DAY-NULM)

(Also read: Google to launch Neighbourly app across India, here are the 15 key features)

(Also read: Loan in 59 minutes, 12 key initiatives for the MSME sector by PM Modi)

Disclaimer: The above post includes some content used from PIB India website and executed on this website for fair use only. As this website is of educational nature, hence the content is used for education and awareness to the public.

Comparison of Gross GST Revenue (Figures on Rs. Crore)

Comparison of Gross GST Revenue (Figures on Rs. Crore)