The total gross GST revenue collected in the month of October, 2018 is Rs. 100,710 crore of which CGST is Rs. 16,464 crore, SGST is Rs. 22,826 crore, IGST is Rs. 53,419 crore (including Rs. 26,908 crore collected on imports) and Cess is Rs. 8,000 crore (including Rs. 955 crore collected on imports).

The total number of GSTR 3B Returns filed for the month of September up to 31st October, 2018 is 67.45 lakh.

The Government has settled Rs. 17,490 crore to CGST and Rs. 15,107 crore to SGST from IGST as regular settlement. Further, Rs. 30,000 crore has been settled from the balance IGST available with the Centre on provisional basis in the ratio of 50:50 between Centre and States. The total revenue earned by Central Government and the State Governments after regular and provisional settlement in the month of October, 2018 is Rs. 48,954 crore for CGST and Rs. 52,934 crore for the SGST.

(Also read: First Aid emergency medical facilities by Indian Railways at all Railway Stations and in all Trains)

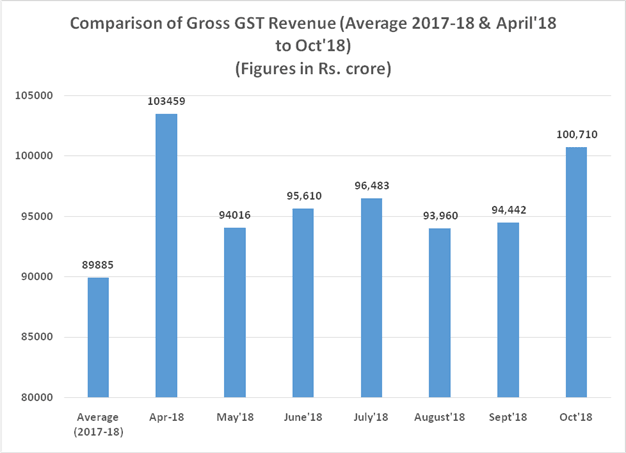

The Revenue collected in October, 2018 of Rs. 100,710 crore is higher by 6.64% as compared to September, 2018 collection of Rs. 94,442 crore. The chart shows trends in revenue during the current year. The States which achieved extra-ordinary growth in total taxes collected from the State assesses include Kerala (44%), Jharkhand (20%), Rajasthan (14%), Uttarakhand (13%) and Maharashtra (11%).

Source: PIB India

Source: PIB India

(Also read: UIDAI introduces "Masked Aadhaar" feature to eAadhaar)

(Also read: Jio has banned many adult websites after the Court Order)

(Also read: No Cost EMI is not interest free, know how No Cost EMI works)

(Also read: Online Safety Tips for Parents, Youngsters and Organisation)

Disclaimer: The above post includes some content used from PIB India website and executed on this website for fair use only. As this website is of educational nature, hence the content is used for education and awareness to the public.