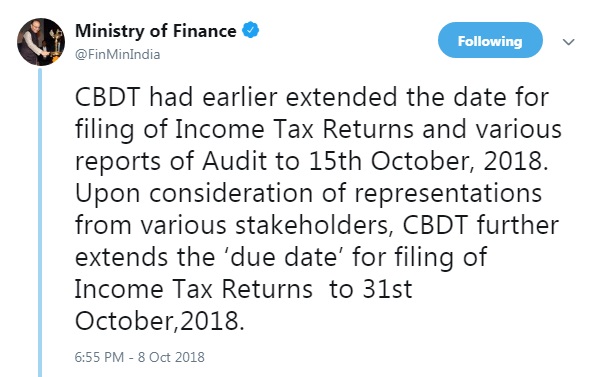

The due date for filing of Income Tax Returns and Audit Reports for Assessment Year 2018-19 is 30th September, 2018 for certain categories of taxpayers. Central Board of Direct Taxes (CBDT) had earlier extended the date for filing of Income Tax Returns and various reports of Audit to 15th October, 2018. Upon consideration of representations from various stakeholders, CBDT further extends the ‘due date’ for filing of Income Tax Returns as well as reports of Audit (which were required to be filed by the said specified date) from 15th October, 2018 to 31st October, 2018 in respect of the said categories of taxpayers. However, as specified in earlier order dated 24.09.2018, assessees filing their return of income within the extended due date shall be liable for levy of interest as per provisions of section 234A of the Income-tax Act, 1961.

(Also read: Impact of ITR and Audit Report due date extension)

(Also read: UPSC allows facility of withdrawal of applications by candidates)

(Also read: Now Aadhar is NOT mandatory for Bank Account, SIM, Exams, says SC)

(Also read: Launch of India's first Methanol based Cooking Fuel)

(Also read: High Level Committee Constituted on Corporate Social Responsibility (CSR))

For more updates:

1. Like our Facebook Page

2. Join our Telegram Group

3. Join our Facebook Group

4. Subscribe to our Youtube Channel

5. Follow us on Twitter

6. Follow us on Instagram

Disclaimer: The above post includes some content used from PIB India website and executed on this website for fair use only. As this website is of educational nature, hence the content is used for education and awareness to the public.