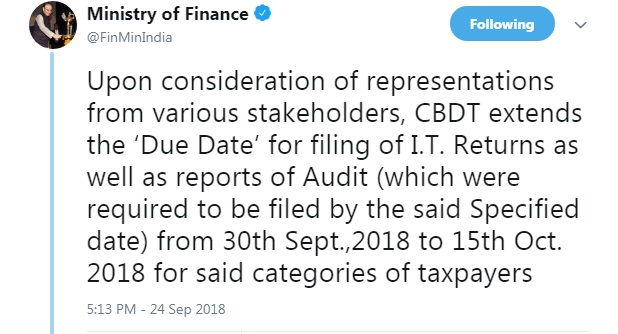

The due date for filing of Income Tax Returns and Audit Reports for Assessment Year 2018-19 is 30th September, 2018 for certain categories of taxpayers. Upon consideration of representations from various stakeholders, the Central Board of Direct Taxes(CBDT) extends the ‘due date’ for filing of Income Tax Returns as well as reports of Audit (which were required to be filed by the said specified date) from 30th September, 2018 to 15th October, 2018 in respect of the said categories of taxpayers. However, there shall be no extension of the due date for the purpose of section 234A (Explanation 1) of the I.T. Act, 1961 pertaining to Interest for defaults in furnishing return, and the assessee shall remain liable for payment of interest as per provisions of section 234A of the Act.

(Also read: PM launches Ayushman Bharat, know the key features)

(Also read: PM announces increase in remuneration for ASHA and Anganwadi workers)

(Also read: MCA notifies Issue & transfer of all shares in dematerialised form only by all unlisted Public companies)

(Also read: TDS and TCS under GST law will be effective from October 1, 2018)

(Also read: Ramdev's entry in Dairy segment, Patanjali to sell even milk and divya water)

For more updates:

1. Like our Facebook Page

2. Join our Telegram Group

3. Join our Facebook Group

4. Subscribe to our Youtube Channel

5. Follow us on Twitter

6. Follow us on Instagram