Spiritual knowledge does not necessarily be tax free. In Maharashtra, the GST court has decided that religious books, religious magazines and DVDs along with Dharamsala and Langer will be within the purview of GST. The court argues that the sale of these items is a business and cannot be tax-free, by assuming them as doles.

The case related to tax near Maharashtra court came against Shrimad Rajchandra Adhyatmik Satsang Sadhana Kendra. In front of the court, the institution argued that its main work is the spread of religious and spiritual education, so their work should not be given a business name.

(Also read: TRAI tighten Call Drop regulations, now weak network will also be covered)

It is noteworthy that under the section 2(17) of the CGST Act, if the trust associated with the religion takes any such work where money is taken for any item or service, then it will be kept by the category of business and the rate of 18% GST will be charged.

With its plea, the institution claimed that in carrying out its main responsibility for religious propaganda, it does the work of Dharamsala and Langer including religious texts, magazines, music CDs and hence, it is to be excluded from the GST scope.

(Also read: Now Metro Cards can be used in DTC buses also)

After considering the arguments of the Shrimad Rajchandra Adhyatmik Satsang Sadhana Kendra, the GST court has ruled that Shivir Satsanga is registered as a charitable organization under section 12A of the Income Tax. In such a situation, its charitable works cannot be excluded from the GST scope.

(Also read: UIDAI issues FAQs on security issues on Aadhaar)

Significantly, only the religious books have been mentioned in the GST Act. But religious books have not been classified in some way. So, in such a situation, it is clear that after the decision of Maharashtra, if any religious institution or trust sells religious texts then it will have to pay GST. However, it is mentioned in the Act that if an institution holds a Grantha /Books /Magazines for public use under any public library, then in such a situation, it will be excluded from the GST scope.

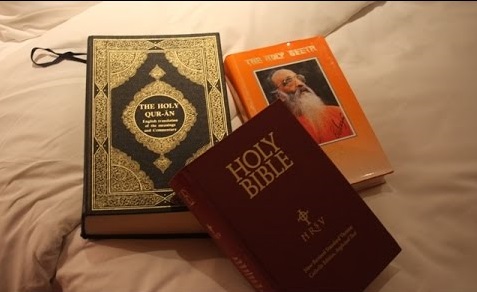

So, now a religious institution sells religious books like Srimad Bhagwat Geeta, Quran or Bible, then it will be kept under the GST.

(Also read: Claims which are not covered under Health Insurance Policy)

For more updates:

1. Like our Facebook Page

2. Join our Telegram Group

3. Join our Facebook Group

4. Subscribe to our Youtube Channel

5. Follow us on Twitter

6. Follow us on Instagram

send the evidences,& court orders & notifications from govt for sale of religious books attract gst