It has been noticed that financial documents/ certificates attested by third person misrepresenting themselves as CA Members are misleading the Authorities and stakeholder. ICAI is also receiving number of complaints of forged signatures. To curb the malpractices, the Professional Development Committee of ICAI has implemented an innovative concept of UDIN i.e. Unique Document Identification Number to secure the certificates/documents attested/certified by practicing Chartered Accountants which will be made mandatory with effect from 1st January, 2019.

1. What is Unique Document Identification Number (UDIN)?

Unique Document Identification Number (UDIN) is a unique number, which will be generated by the system for every document certified/ attested by a Chartered Accountant and registered with the UDIN portal.

2. What is the Algorithm of UDIN?

Algorithm of UDIN comprises of the following:

1. The Membership Number of the Member attesting the document/ certificate.

2. The Date (dd/mm/yy) when certificate is issued.

3. The Document Serial Number allotted automatically by system.

3. Why UDIN?

It has been noticed that financial statements and documents were being certified/attested by third persons (who are not Chartered Accountant in practice), in lieu of Chartered Accountants. A big example of it was seen somewhere in case of PNB Scam and other financial blunders in the country. As these statements are being relied upon by the authorities as true statements and certificates, UDIN can be generated by a practicing CA by registering his/her documents/ certificates on UDIN Portal for verification.

4. Who can generate UDIN?

A practising Chartered Accountant can generate a UDIN for certificate/ document attested by him either in individual capacity or as a partner.

5. Whether UDIN is mandatory for the CA members of ICAI for each certification done?

At present, this facility is recommendatory. But ICAI is mulling to make the same compulsory in near future, so as to curb the menace of fake or forged documents.

6. What is the link to crosscheck whether the certificate number so indicated is valid?

The Certificate Number can be cross checked from here

7. How many UDINs can be generated by a CA? Is there any limit?

There is no restriction on the number of UDINs to be generated by a CA.

8. How to create an account on the UDIN portal?

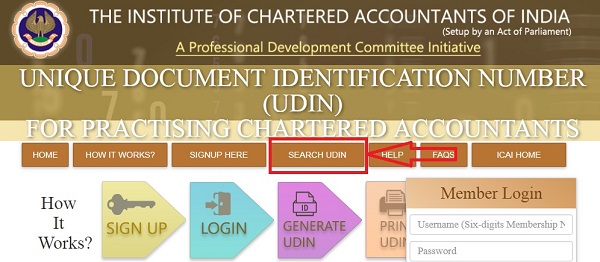

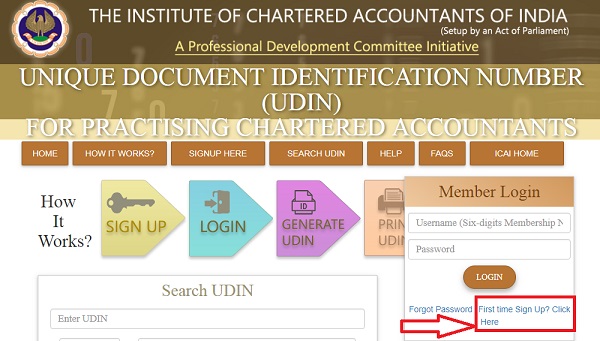

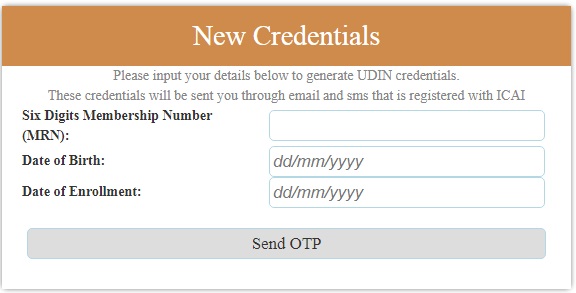

Step 1: Enter the homepage of UDIN portal

Step 2: Click button “For first time sign up, click here”

Step 3: Enter your six-digit Membership No., Date of Birth and Date of Enrollment, and click the “Send OTP”.

An OTP will be sent to you at the mobile and email, as registered with the ICAI.

Step 4: Enter OTP received and click “Continue”, you will receive username and system generated password at the mobile and email, as registered with the ICAI.

9. How to generate a Unique Document Identification Number (UDIN)?

i. After login, click “Generate UDIN”

ii. Enter details such as, your Client Reference Code/Number, Document Issued, Document Description, Date of Document, Keywords/Values (minimum three) with in the document and click the button “Send OTP”. Firm Registration Number (FRN) is Optional.

iii. An OTP will be sent to you at the mobile and email, as registered with the ICAI.

iv. Enter OTP received and click the button “Preview”. You will see the details you have entered for generating the UDIN.

v. If there is any change in the content, you should click the button “Back” or else click the button “Submit”

vi. A UDIN will be generated and you can use that UDIN on the document for which it has been Generated

UDIN that have been generated would be displayed as watermarked on document(s) else the UDIN can be mentioned on the document(s) using a pen. “List UDIN” menu can be used to print the UDIN.

10. Can one see the various certificate numbers generated?

Yes, one can see and search the various certificates number generated using the search option.

11. Is any modification possible in case incorrect information such as client reference code/number, Document Issued Under, Document Description, Date of Document, Keywords within the document, etc., has been submitted?

No change is possible in the data already registered by a Chartered Accountant in the online system. Therefore, members are requested to thoroughly check the details in preview option before submission of their application. Information filled in can be edited/ modified any number of times before the submission. But once it is submitted, it cannot be edited.

12. Can a certificate number once generated be revoked or cancelled?

The UDIN once generated can be withdrawn or cancelled with narration. Hence if any user search for this UDIN, appropriate narration indicated by Member with the date of revoke will be displayed for reference.

13. What is the validity of a UDIN on the portal for viewing by a third party?

As of now, there is no time limit.

14. Is UDIN mandatorily required to be registered for the search?

Yes, UDIN will be available for search by the end user only after registration.

15. What are the key values and are they necessary?

While registering the certificate for generation of UDIN, the member has to compulsorily provide Key values (minimum three and maximum five), which are found in the document or certificate generated. Key values can be any financial figure extracted from the attested statement or certificate such as Turnover, Net profit, Utilization amount, Import amount, Export amount, Duty refund, Refund, Net worth, Revenue, Input tax credit, Loan amount, Total Assets, Net owned funds, Profitability, Capital To Risk Asset Ratio (CRAR), Statutory Liquidity Ratio, Gross fixed assets, Net loss, Misc. expenditure, Total capital investment, Sanction amount, Other (please specify any key words), etc.

16. What happens if while registering on UDIN Portal, the information is not accepted or the password is not sent?

Credentials do not match with the database as maintained by the regional offices. Probably, the database maintained does not have the correct email ID or mobile number, or the regional offices may have entered the same wrongly. For example, entering multiple email IDs in one field, providing space before the email IDs, etc.

You may reach the PDC Department by writing to udin@icai.org. For all issues relating to the data regarding enrolment dates, DOB, email IDs, phone number corrections, etc., please get in touch with the respective regional offices.

17. Is online generation of UID number is mandatory? Or, if the UID number is generated offline, can the same be entered in back date?

Yes, it is mandatory that the numbers to be generated online only.

18. How will the UDIN appear on the documents?

UDIN that have been generated would be displayed as watermarked on document(s) else the UDIN can be mentioned on the document(s) using a pen. “List UDIN” menu can be used to print the UDIN.

19. Can UDIN be generated as per the category of the area of certificate?

Yes, UDIN can be generated in the specific area of certificate, like Goods & Service Tax Act, Banks, Companies Act, Income-tax Act, finance and capital market, public finance and government accounting, etc,.

(Also read: CBDT extended due date for filing of ITRs and Audit Reports to 15 October 2018)

(Also read: Impact of ITR and Audit Report due date extension)

(Also read: MCA notifies Issue & transfer of all shares in dematerialised form only by all unlisted Public companies)

(Also read: TDS and TCS under GST law will be effective from October 1, 2018)

Disclaimer: The above post includes some content used from UDIN portal and executed on this website for fair use only. As this website is of educational nature, hence the content is used for education and awareness to the public.