Several attractive benefits to provide tax relief to salaried individuals and pensioners opting for the new tax regime were announced by the Union Finance and Corporate Affairs Minister Smt. Nirmala Sitharaman while presenting the Union Budget 2024-25 in the Parliament today, on 23 July 2024. Here are the key highlights of Budget 2024-25 regarding Direct Taxes:

A. Changes under the New tax regime only:

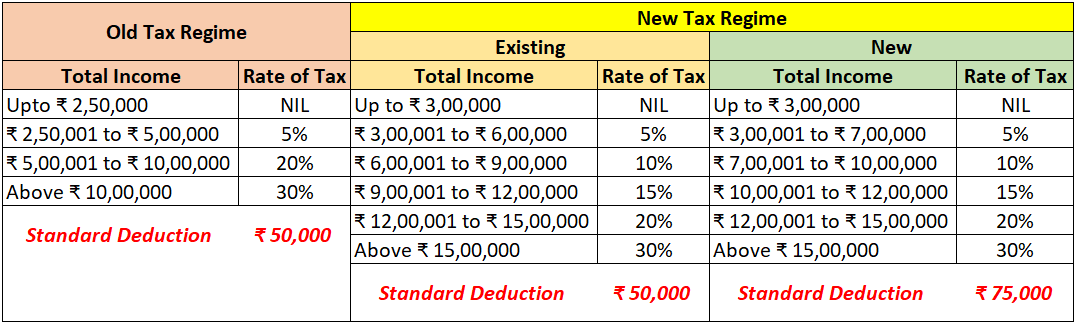

1. Standard deduction for salaried employees increased from ₹ 50,000 to ₹ 75,000 under the New tax regime only. It may be noted that the standard deduction under Old tax regime is still the ₹ 50,000.

2. Deduction of expenditure by non-Government employers towards NPS under section 80CCD(2) is increased from 10% to 14% of the employee’s salary under New tax regime only. This will apply to public sector companies and private sector companies. Government employees already enjoy a deduction of 14% under section 80CCD(2). It may be noted that the deduction under section 80CCD(2) under Old tax regime is still the 10% for non-Government employees.

3. Deduction on family pension for pensioners is increased from ₹ 15,000 to ₹ 25,000 under the New Tax Regime only.

4. Tax slab under New Tax Regime:

B. Changes under Both the tax regimes:

1. Tax on short term capital gains on financial assets is increased from 15% to 20%.

2. Tax on long term capital gains on all financial and non-financial assets is increased from 10% to 12.5%. Further, the limit of exemption of capital gains on financial assets is increased from ₹ 1,00,000 to ₹ 1,25,000.

3. Tax on long-term capital gain on sale of property is reduced from 20% to 12.5%. Further, the benefit of indexation on sale of property will not be available. The new norms are applicable with immediate effect, which is from July 23, 2024 onwards.

4. Corporate tax rate on foreign companies is reduced from 40% to 35%.

5. TDS rate on e-commerce operators is reduced from 1% to 0.1%.

6. Security Transactions Tax (STT) on futures and options (F&O) of securities increased to 0.02% and 0.1% respectively.

7. Income received on buy back of shares to be taxed in the hands of recipient.

8. Non-reporting of small movable foreign assets up to ₹ 20 lakh de-penalised.

9. Equalization levy of 2% is withdrawn.

10. Delay for payment of TDS up to due date of filing statement decriminalized.

11. Assessment can be re-opened beyond 3 years upto 5 years from the end of Assessment Year only if the escaped income is ₹ 50 lakh or more.

12. In search cases, time limit reduced from 10 to 6 years before the year of search.

13. All remaining services of Customs and Income Tax including rectification and order giving effect to appellate orders to be digitalized over the next 2 years.

(Also read: Top 8 reasons for Income Tax Notice)

(Also read: 10 tips for using your Credit Card smartly)

(Also read: RBI warns against loan waiver scams)

(Also read: Hotels or Restaurants cannot add Service charge automatically or by default in the Food bill)

(Also read: Government sets penalty upto Rs. 50 Lakhs for misleading advertisements and endorsements)

Disclaimer: The above post includes some content used from PIB website and executed on this website for fair use only. As this website is of educational nature, hence the content is used for education and awareness to the public.

Title Tags: Unveiling Direct Tax Changes in Budget 2024-25; Key Direct Tax Highlights from Budget 2024-25; Direct Tax Proposals in Budget 2024-25; Direct Tax Changes Announced in 2024-25; Top Direct Tax Changes in Budget 2024-25; Direct Tax Amendments and Key Insights; Summary of Direct Tax Highlights in Budget 2024-25