The financial year 2023-24 (assessment year 2024-25) has ended and due date for filing of Income Tax Return (ITR) for salaried and other individuals is 31 July 2024. It may be confusing as to which tax regime shall be opted so that the tax liability can be as minimum as possible. So, in this article, key differences between both the regimes are discussed in Part-A and how to select tax regime with the help of income and deduction amount are discussed in Part-B.

Part-A: Difference between Old Tax Regime and New Tax Regime

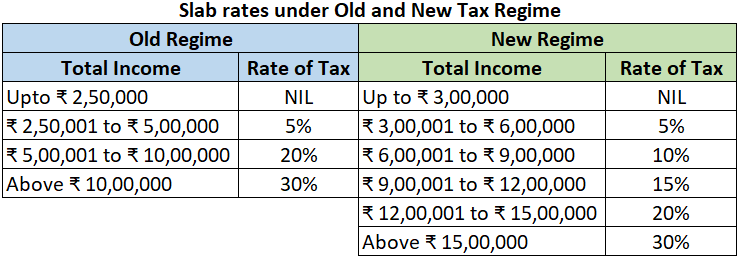

1. Basic exemption limit: The basic exemption means that amount of income on which no tax is to be paid by taxpayer. The basic exemption limit is ₹ 2,50,000 under old regime and ₹ 3,00,000 under new regime.

2. Tax rebate limit: The tax liability calculated according to slab rate will be payable by taxpayer but the Income Tax provides 100% rebate on such tax liability if the income of an individual is up to specified limit. It means the individual will not have to pay any tax. The specified limit of income is ₹ 5,00,000 under old regime and ₹ 7,00,000 under new regime.

3. Higher tax rate limit: The higher tax rate limit means the income which attract the higher tax rate of 30%. The higher tax rate limit of income is ₹ 10,00,001 under old regime and ₹ 15,00,001 under new regime.

4. Standard deduction from salary income: The standard deduction of ₹ 50,000 is allowed to be deducted from salary income under both the tax regime. It means if an individual has salary income of ₹ 5,50,000 under old regime and ₹ 7,50,000 under new regime, then his/her tax liability will be nil (after considering tax rebate). This is discussed in details in comparison chart given below.

5. Higher surcharge rate: Surcharge means tax on tax. It is in addition to the income tax. If the income of an individual is more than ₹ 50,00,000, he/she will be charged the surcharge on income tax liability at specified rate. The maximum surcharge rate is 37% under old regime and 25% under new regime.

6. Contribution to NPS: The contribution made to NPS is allowed to be deducted from income for employee’s share u/s 80CCD(1) as well as employer’s share u/s 80CCD(2) under the old regime but under the new regime, the contribution made to NPS only by employer u/s 80CCD(2) is allowed to be deducted from the income.

7. Set off and carry forward of house property loss: The loss from house property can be set off from other heads of income upto ₹ 2,00,000 and remaining loss shall be carry forward to next year which will be adjusted only with house property income in next year under old regime but under new regime, the loss from house property can only be carry forward to next year which will be adjusted only with house property income in next year (i.e. set off from other heads of income is not allowed).

8. Other exemptions/deductions which are allowed only in old regime but not in new regime are as follows:

- House Rent Allowance (HRA)

- Leave Travel Allowance (LTA)

- Entertainment Allowance

- Professional Tax

- Deduction of interest on home loan from the income of house property (self-occupied/vacated)

- Deduction under section 80C (LIC, ELSS, PPF, FD, children’s tuition fees, repayment of home loan etc.)

- Deduction under section 80D (Medical insurance premium)

- Deduction under section 80CCD(1) (Employee’s own contribution to NPS)

- Deduction under section 80E (Interest on education loan)

- Deduction under section 80EEB (Interest on electric vehicle loan)

- Deduction under section 80G (Donation to political party/trust)

- Deduction under section 80TTA and 80TTB (Interest on saving bank interest)

Part-B: Which tax regime shall be chosen with the help of income and deductions:

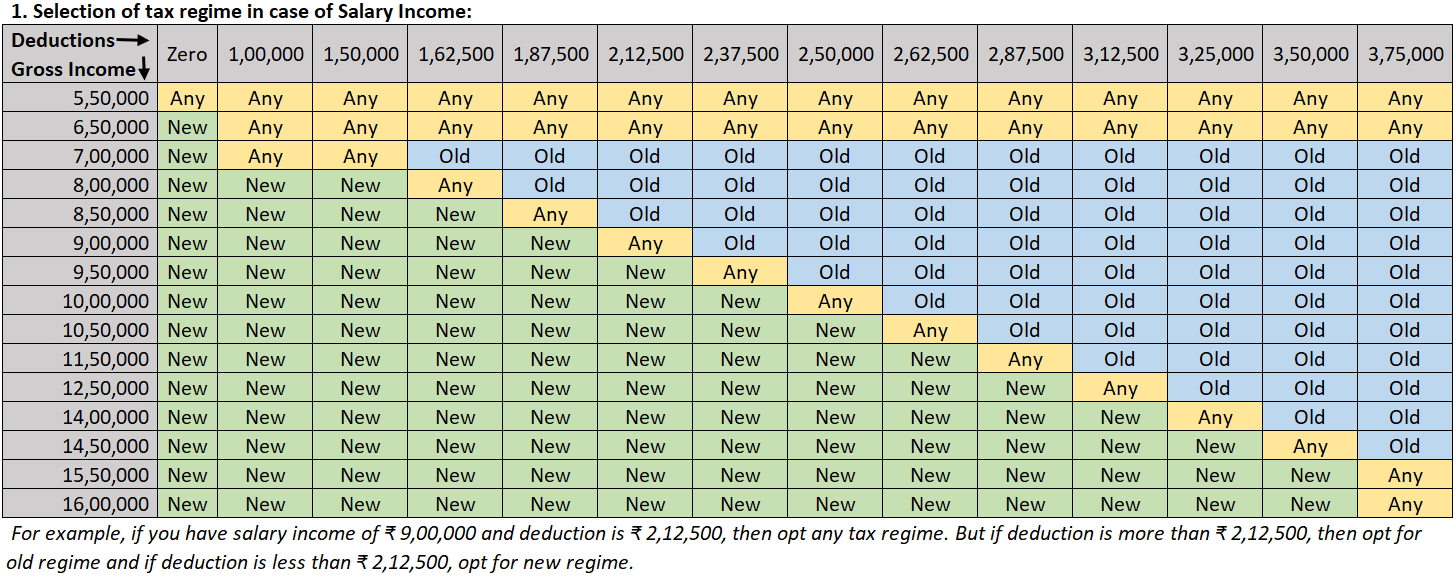

1. Selection of tax regime in case of Salary Income:

2. Selection of tax regime in case of income other than Salary:

If you want to know more about Income Tax Returns (ITRs), click on the followings:

- ITR-1 (click here)

- ITR-2 (click here)

- ITR-3 (click here)

- ITR-4 (click here)

- ITR-5 (click here)

- ITR-6 (click here)

- ITR-7 (click here)

(Also read: Top 8 reasons for Income Tax Notice)

(Also read: CBDT enables filing for ITR-1, 2, 4 and 6 for AY 2024-25)

(Also read: 10 tips for using your Credit Card smartly)

(Also read: RBI warns against loan waiver scams)

Title Tags: How to select tax regime for AY 2024-25; Which tax regime will be beneficial for AY 2024-25; Old tax regime or new tax regime - which one fits your financial goals?; Old tax regime vs new tax regime explained in detail; All about old tax regime vs new tax regime; Old vs. New Regimes Explained; Old Regime vs. New Regime Comparison; Old vs. New Regime Differences; Old vs. New Tax Regime Strategies; Old vs. New Regime Tactics; A Simple Guide to Old & New Tax Regimes; Choosing Between Old & New Tax Systems; A Comparison of Old vs. New Regimes; Should You Stick with the Old Regime or Switch; Old vs. New Regime for Different Income Groups