Gross GST revenue collection for March 2024 witnessed the second highest collection ever at ₹ 1.78 lakh crore, with a 11.5% year-on-year growth. This surge was driven by a significant rise in GST collection from domestic transactions at 17.6%. GST revenue net of refunds for March 2024 is ₹ 1.65 lakh crore which is growth of 18.4% over same period last year.

Breakdown of March 2024 collections:

- Central Goods and Services Tax (CGST): ₹ 34,532 crore;

- State Goods and Services Tax (SGST): ₹ 43,746 crore;

- Integrated Goods and Services Tax (IGST): ₹ 87,947 crore, including ₹ 40,322 crore collected on imported goods;

- Cess: ₹ 12,259 crore, including ₹ 996 crore collected on imported goods.

Breakdown of entire FY 2023-24 collections:

- Central Goods and Services Tax (CGST): ₹ 3,75,710 crore;

- State Goods and Services Tax (SGST): ₹ 4,71,195 crore;

- Integrated Goods and Services Tax (IGST): ₹ 10,26,790 crore, including ₹ 4,83,086 crore collected on imported goods;

- Cess: ₹ 1,44,554 crore, including ₹ 11,915 crore collected on imported goods.

Inter-Governmental Settlement:

In the month of March, 2024, the Central Government settled ₹ 43,264 crore to CGST and ₹ 37,704 crore to SGST from the IGST collected. This translates to a total revenue of ₹ 77,796 crore for CGST and ₹ 81,450 crore for SGST for March, 2024 after regular settlement. For the FY 2023-24, the central government settled ₹ 4,87,039 crore to CGST and ₹ 4,12,028 crore to SGST from the IGST collected.

Strong Consistent Performance in FY 2023-24:

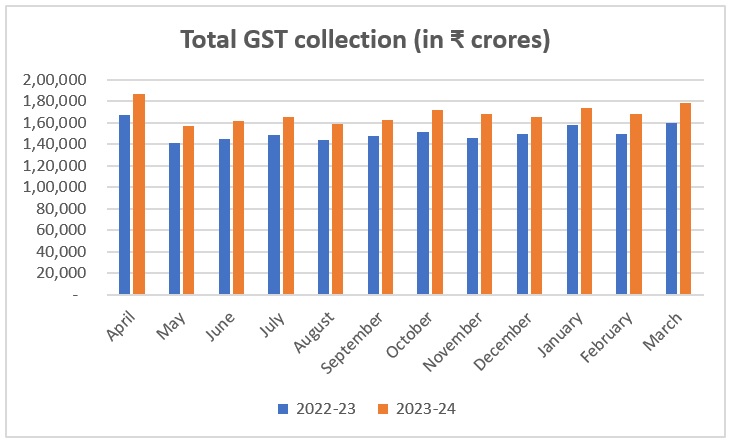

FY 2023-24 marks a milestone with total gross GST collection of ₹ 20.14 lakh crore exceeding ₹ 20 lakh crore, a 11.7% increase compared to the previous year. The average monthly collection for this fiscal year stands at ₹ 1.68 lakh crore, surpassing the previous year’s average of ₹ 1.5 lakh crore. GST revenue net of refunds as of March 2024 for the current fiscal year is ₹ 18.01 lakh crore which is a growth of 13.4% over same period last year.

The chart below shows trends in monthly gross GST revenues during the current year 2023-24 as compared to previous year 2022-23.

(Also read: Government of India notifies calendar for auction of Treasury Bills)

(Also read: Marketable dated securities issuance calendar for April-September 2024)

(Also read: 10 tips for using your Credit Card smartly)

(Also read: RBI warns against loan waiver scams)

(Also read: Hotels or Restaurants cannot add Service charge automatically or by default in the Food bill)

(Also read: Government sets penalty upto Rs. 50 Lakhs for misleading advertisements and endorsements)

Disclaimer: The above post includes some content used from PIB website and executed on this website for fair use only. As this website is of educational nature, hence the content is used for education and awareness to the public.

Title Tags: Key Highlights of March 2024 GST Revenue Collection Report; Breaking Down India's GST Revenue Collection for March 2024; Government Analyses March 2024 GST Revenue