The gross GST revenue collected in the month of February 2022 is Rs.1,33,026 crore of which CGST is Rs. 24,435 crore, SGST is Rs. 30,779 crore, IGST is Rs. 67,471 crore (including Rs. 33,837 crore collected on import of goods) and cess is Rs. 10,340 crore (including Rs. 638 crore collected on import of goods).

The government has settled Rs. 26,347 crore to CGST and Rs. 21,909 crore to SGST from IGST. The total revenue of Centre and the States in the month of February 2022 after regular settlement is Rs. 50,782 crore for CGST and Rs. 52,688 crore for the SGST.

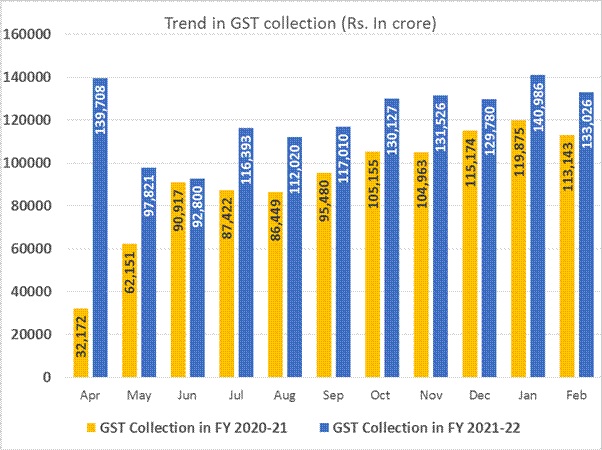

The revenues for the month of February 2022 are 18% higher than the GST revenues in the same month last year and 26% higher than the GST revenues in February 2020. During the month, revenues from import of goods was 38% higher and the revenues from domestic transaction (including import of services) are 12% higher than the revenues from these sources during the same month last year.

February, being a 28-day month, normally witnesses revenues lower than that in January. This high growth during February 2022 should also be seen in the context of partial lockdowns, weekend and night curfews and various restrictions that were put in place by various States due to the omicron wave, which peaked around 20th January.

This is for the fifth time GST collection has crossed Rs. 1.30 lakh crore mark. Since implementation of GST, for the first time, GST cess collection crossed Rs. 10,000 crore mark, which signifies recovery of certain key sectors, especially, automobile sales.

The chart below shows trends in monthly gross GST revenues during the current year as compared to preceding year.

(Also read: GST Revenue collection for January 2022)

(Also read: FRN will be compulsory field for UDIN generation from 01 February 2022)

(Also read: No restrictions on account operations due to non-compliance of KYC till 31 March 2022)

(Also read: 10 best investments for Tax Saving)

Disclaimer: The above post includes some content used from PIB India website and executed on this website for fair use only. As this website is of educational nature, hence the content is used for education and awareness to the public.

Nice