CBDT has extended the date of linking Pan-Aadhaar to March 31, 2019. This is the 5th time when the government has decided to extend the time limit for linking the permanent account number (PAN) with the Aadhaar. Before this, the timing of linking the two databases was July 31, 2017, August, 31, 2017, December 31, 2017, 31 March, 2018 and 30 June, 2018.

The tax department's policy-maker has decided at late night to extend the deadline as per Section 119 of the Income Tax Act. It has been said in the latest judgment that after considering the matter, the deadline for linking the PAN and Aadhaar for filing income tax return has been extended.

The government now wants to make the Aadhaar necessary for the creation of a new PAN card and filing income tax. Under Section 139AA (2) of the Income Tax Act, anyone who has a PAN card on July 1, 2017 and who is eligible for the Aadhaar, must give the tax authority its Aadhaar number information.

According to data collected till March, there are a total of 33 crore PAN cards in the country, out of which about 16.65 crore have been linked from the Aadhaar.

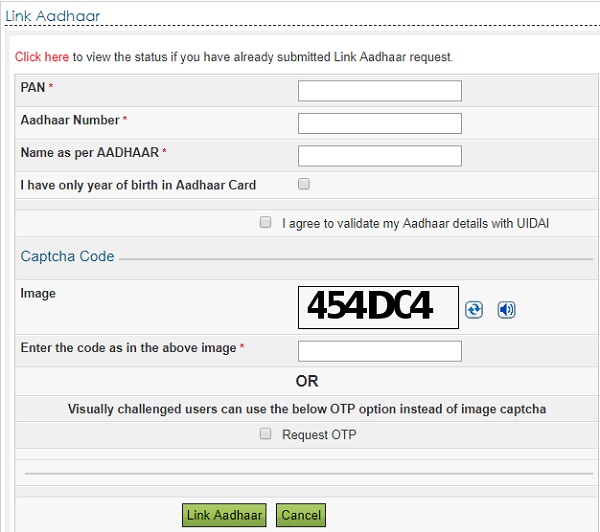

How to link:

1. Go to the Income Tax Department e-filing website.

2. Click on 'Link Aadhar' red colored link on the left side.

3. If your account is not created then first activate your PAN by registering it.

4. Enter PAN, Aadhar Number, Name as per Aadhar, Date of Birth and Captcha Code

5. OTP will be received on registered mobile number

6. Enter OTP and click on ‘Link Aadhar’

Note:

1. The mobile number shall be registered in Aadhar database.

2. The exact match of Name, Address and other parameters as in Aadhar will be allowed to link.

For more updates,

1. Like our Facebook Page

2. Join our Telegram Group

3. Join our Facebook Group

4. Subscribe to our Youtube Channel

5. Follow us on Twitter

6. Follow us on Instagram